How can Supply Chain Solutions solve Zombification?

Using our Peer Benchmark Comparison Tool and Altman Z-score, we demonstrate how leading manufacturing companies have been impacted by COVID-19 and how they are on the path to becoming Zombie firms. In addition, we show how our integrated supply chain solutions can help alleviate this financial pressure.

Business turbulence looks set to continue for the foreseeable future because of COVID-19. It has created severe challenges for businesses with significant job losses, reduced sales, and worldwide supply chain disruption. And now as the economy sets to recover, many have taken advantage of various financial support schemes offered by their local governments. However, this is not without its own risks since it provides a false sense of security. Companies that rely on this debt or financial support to stay afloat run the risk of becoming Zombie Firms.

What is a Zombie firm?

A zombie firm is a company that earns just enough money to continue operating and service debt but are unable to pay it off. Such companies, given that they just stay afloat by meeting overheads (wages, rent, interest payments on debt, etc.), have no excess capital to invest to drive growth. Moreover, the zombification of firms is no longer solely associated with smaller companies, many of the Standard & Poor’s 500 (S&P500) are now at risk. This is a worrying development as the S&P500 is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States and is one of the most followed equity indices. Therefore, it is reasonable to assume that if the S&P500 are struggling then lesser known companies are also facing considerable difficulties.

How do we analyse a company’s finacnial situtation?

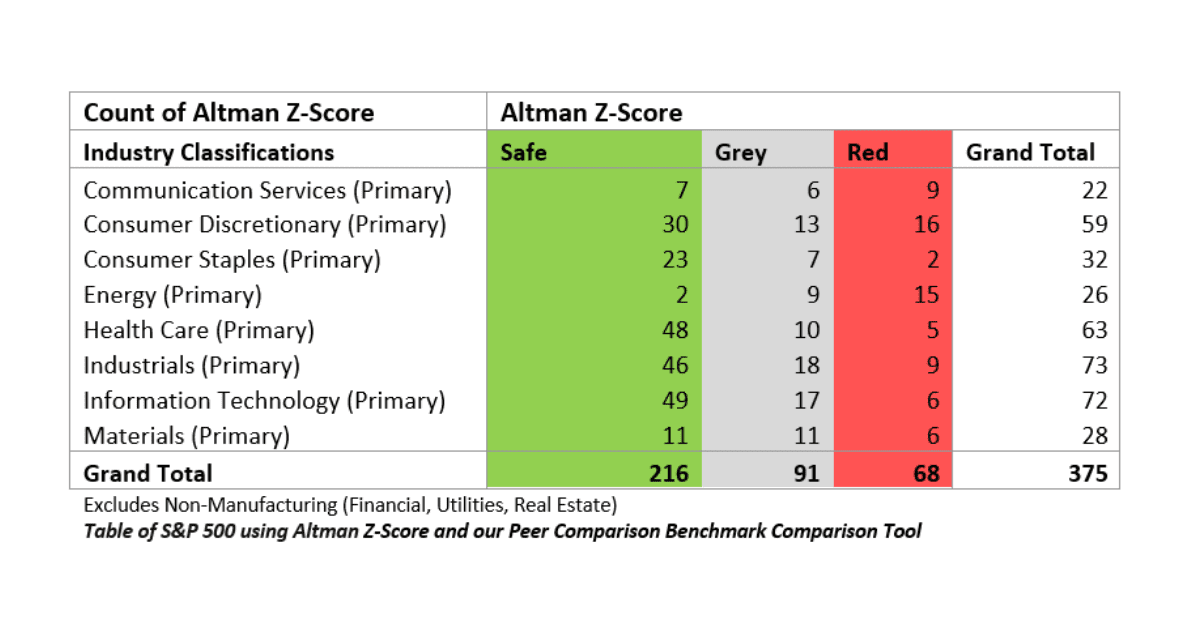

Using our data analytics tools, we took a deep dive below the surface of the financial situation of S&P500 using our Peer Comparison Benchmark Tool and the Altman Z-score, a tool designed to gauge credit strength of publicly traded manufacturing companies. It is used to obtain a condensed picture of the financial strength of a company and serves as a benchmark for credit risk assessment models.

In our research, we removed non-manufacturing companies including Financial, Real Estate and Utilities to get a better sense of the industries under most pressure. Illustrated in the table below, Consumer Discretionary and Energy are the two standouts in Red, yet it is notable how all sectors are strongly represented in the Grey zone. Roughly 40% of the entire S&P500 manufacturing base is flagging some degree of financial distress, a worrying situation that pre-dates COVID-19.

How can Supply Chain Solutions alleviate financial pressure?

The effects of COVID-19 will continue to impact all aspect of a business well into the future and it is no longer just a financial issue. It is important to look at all facets of your business, especially your supply chain, as there is much that can be done within this sphere to help alleviate financial pressure. There are three key areas of focus to help a company develop a flexible and resilient supply chain to future proof your business:

1. Gross Margin %: Below average gross margin indicates reduced or weakened buying power. One area of notable opportunity to improve this is establishing a clear understanding of market pricing and technology platforms available to drive down freight and warehousing costs while improving services.

- Contact Titan Solutions to learn more about our integrated ERP-WMS-TMS Freight & Distribution ecosystem.

2. Fixed Asset Turnover: Below average turnover indicates potential to free up capital (reduce operating costs and improve service) through a review and redesign of your manufacturing and distribution network.

- Contact Titan Solutions to learn more about our Network Design & Inventory Optimisation.

3. Inventory Turnover: Inventory undergoes a devaluation process once it leaves manufacturing area. It is a major component of reinvestment which is tracked very closely by the analyst community through the sales to capital ratio. It is recommended that businesses have a reliable planning and analysis system to help accurately track and monitor your inventory turnover.

- Contact Titan Solutions for details of our inventory analysis and planning programs.

As companies continue to reassess their capital requirements, they need to consider drawing on specialist expertise to free up fixed capital investment, reduce operating costs and to bring themselves in line with their peer groups norms. The backbone of all Titan Solutions services is our industry leading integrated data analytics platform which collates all supply chain activity and costs into real-time view through interactive dashboards to develop a robust, flexible, and transparent operating system.

For more information on how to optimise your supply chain, chat with us today